Ghana Priorities: Industrial Policy

Technical Report

The Problem

Although Ghana has witnessed some impressive growth in recent times, past experiences with industrialization have not been as expected. There are several reasons for this: informality, poor infrastructure, lack of skilled labour, poor management practices, financial constraints and inadequate technological innovation. Indeed, the industrial sector that is supposed to be an important source of employment and economic growth rather lags behind the services sector in terms of contribution to GDP and employment. It is widely known that industrial transformation has been the source of growth and employment creation for many advanced economies in the West and especially the Asian Tigers. Ghana, therefore, needs to structurally transform its industrial sector to enhance its growth and employment prospects as expected.

Intervention 1: Management Training for large manufacturing enterprises

Overview

Management practices in developing countries considerably lag behind those in advanced economies. There is, therefore, the need to improve such practices to enhance industrial growth. This intervention seeks to provide management training to local (non-multinational) factories that relatively have large turnovers (large firms).

Implementation Considerations

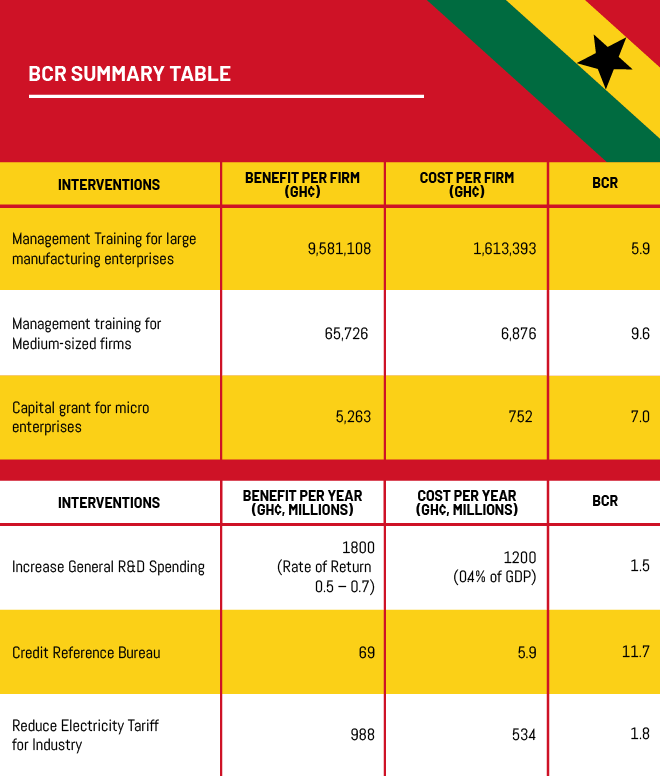

We estimate that this would require consulting services costing GHS 1.59m per factory. The cost of the consulting service could be paid by the government. This intervention could, therefore, be classified as government investment to boost private sector contribution to the manufacturing sector. Some additional costs would, however, be borne by the firms as investments to enable recommendations for a total cost of GHS1.62M per factory.

Costs and Benefits

Costs

The total cost of the intervention is estimated at GHS1.62M per factory. The intervention will be in the form of a consultancy service on various management practices: factory operations, quality control, inventory, human resources management and sale and order management.

Benefits

This intervention would increase the profits of the local (non-multinational) factories with relatively large turnovers. It is expected that the total profit for a period of 6 years will be GHS 10.5M. The benefits for this intervention are likely to be underestimated since we anticipate some spillover effects of this intervention for other firms, especially local firms.

Intervention 2: Management training for Medium-sized firms

Overview

This intervention seeks to provide management training for medium-sized firms. This intervention is conceptually the same as Intervention 1, except that the type of management training required by the medium-sized firms, to make them profitable, may not be the same for large firms.

Implementation Considerations

This intervention will require hiring a consultant to train the owners of medium-sized firms on some specific management modules. We estimate that this would require a cost of GHS 4,355 per factory. Some additional costs would, however, be borne by the firms as investments to enable the full realization of the training program.

Costs and Benefits

Costs

The total cost of the intervention is estimated at GHS6,876 per firm. Additional investment costs resulting from the training are estimated at GHS142.

Benefits

This intervention would increase the profits of medium-sized firms. It is expected that the total profit for the first year will be GHS 70,985. We anticipate some spillover effects of this intervention for other firms, especially local firms.

Intervention 3: Capital grant for microenterprises

Overview

This intervention seeks to provide a capital grant to some selected microenterprises within the manufacturing sector in Ghana. The capital grant could be in the form of an in-kind grant. The main target group for this intervention is micro-enterprises within the manufacturing sector.

Implementation Considerations

These firms shall receive an in-kind payment worth GH683 and will be distributed to some selected microenterprises in Accra and Tema in 2019. Hypothetically, identification and selection of firms will be in two levels. Beneficiary firms would first be selected by their tax compliance status, thus firms that do not comply with tax laws are not likely to be selected. The next level of selection would be based on randomization.

Costs and Benefits

Costs

The total cost for this intervention per each enterprise is GH752.

Benefits

The benefit is assumed to last for 3 years hence profit likely to accrue to the firm within a period of 3 years is GHS5,263 (at a discount rate of 8%).

Intervention 4: Increased General R&D Spending

Overview

Although poor countries have low returns to R&D because the supporting infrastructure to take advantage of such investments (good management practices, rule of law, financial market sophistication etc.) is absent, we argue that some productivity improvements are still envisaged. This intervention appraised the returns of doubling the current R&D spending of 0.4 percent.

Implementation Considerations

Costs and Benefits

Costs

Increase R&D spending by 0.4 percent of GDP per capita (double of the spending to 0.8%)

Benefits

An estimated rate of return of R&D spending between 0.5 – 0.7

Intervention 5: Credit Reference Bureau

Overview

The proposed intervention involves building the capacity of the regulator to ensure effective surveillance of the credit referencing system to improve on the quality of information in circulation while enforcing an appropriate rewards and sanctions regime per the CRB Act.

Implementation Considerations

The intervention facilitates the inclusion of additional information into the credit referencing system. These include data from Fintechs (some of which are aligned to Telecommunication companies), mining companies, wholesalers, court records and tax records.

Costs and Benefits

Costs

The overall undiscounted cost is approximately GHS5.9m

Benefits

A change in consumer surplus is estimated as GHS69m.

Intervention 6: Reduce Electricity Tariff for Industry

Overview

This intervention aims at providing subsidies or reducing the electricity tariffs payable by manufacturing firms and industry. While one approach is to raise costs on residential users, we chose an intervention that provides subsidies since it is unlikely for the former to be politically feasible.

Implementation Considerations

There are four categories of consumers in Ghana. These are residential, non-residential (commercial), Special Load Tariff (SLTs) for industry and street lighting. We focus on SLTs.

Costs and Benefits

Costs

The total cost of the intervention is obtained by adding the value of transfer (that is subsidy paid by the government) to the value of additional electricity. This becomes GHS 534m.

Benefits

The total welfare estimate for the intervention is GHS 987m.