Ghana Priorities: Digitization

Technical Report

The Problem

A key indicator of successful decentralization processes is the ability of local governments to generate their own income. Although Ghana’s fiscal decentralization framework allows for fiscal autonomy of local governments, the Metropolitan, Municipal and District Assemblies (MMDAs) still depend principally on central government transfers to fund their development. Despite their jurisdictional advantage, MMDAs only generate, on average, approximately 20 percent of their total budget from their own sources, known as Internally Generated Funds (IGF).

MMDAs have important planning and coordination functions, as well as the responsibility for infrastructure and service delivery in key sectors: waste management, transport, roads, housing, disaster prevention, births and deaths, among others (World Bank, 2018). Before the introduction of dLRev, most assemblies issued demand notices to clients for the payment of the rates, rents and other bills. The majority of these were not computerized but hand-written bills. As most buildings were not numbered, even the distribution of the bills posed a major challenge to the MMDA’s revenue collectors. In some MMDAs the billing was decentralized; that is, sub-districts printed their own bills and issued them to taxpayers. This caused a lot of leakages.

There have also been regulatory and monitoring challenges associated with the practice of outsourcing revenue collection. MMDAs have raised concerns about the proprietary nature of the data collected, the extent to which they can monitor and sanction service providers, the modalities for procurement, among others.

Finally, there was (and still is) no legal backing for the policies and procedures to guide the MMDA management in the outsourcing process, including the selection of revenue sources to be outsourced and those to be collected "in-house" by the MMDA.

Despite these challenges, the efficient taxation of properties within their respective jurisdictions is a huge untapped potential to increase local governments’ IGF.

Intervention 1: The Implementation of dLRev management software in a model MMDA in Ghana

Overview

The dLRev is a web-based application with a digital address map (local plan) of a district produced using a geographic information system. The local plan has a spatial database and with a corresponding fiscal cadastre of revenue items, the software is used to manage data, billing, and collection. The software is currently set-up for property rates and business operating permits, but also provides for other revenue items namely rents (district infrastructure given for public use such as market sheds, stalls and stores), fees (for use of market grounds and lorry parks), fines (for flouting by-laws of the local authority) and investment (investment in securities). The application was funded by GIZ, who also partake in some of the implementation activities with government. A historical overview of the development of the dLRev software can be found in Appendix 1.

In January 2020, the GovID programme and the Copenhagen Consensus Center agreed to conduct a cost-benefit analysis of the deployment of the dLRev revenue management software in 9 MMDAs in Ghana, which used the dLRev software in the fiscal year 2019.

These are:

Central Region: Agona West Municipal Assembly, Cape Coast Metropolitan Assembly, Komenda-Edina-Eguafo-Abirem (KEEA) Municipal Assembly

Eastern Region: Suhum Municipal Assembly

Greater Accra: Adenta Municipal Assembly, Ga South Municipal Assembly

Western Region: Bibiani-Anhwiaso-Bekwai District Assembly, Shama District Assembly, Prestea Huni - Valley District Assembly

Intervention

While fifty-two MMDAS (52) were set-up on the dLRev platform by the end of 2019, nine (9) municipalities have been using the dLRev software throughout the year 2019 to collect rates for both properties and businesses. The intervention proposed here is to use the cost and revenue data obtained from those nine (9) municipalities in order to estimate the costs and benefits of implementing the dLRev software in a model MMDA.

The model MMDA is essentially a weighted average of the contributing municipalities; the weight based on their respective population sizes of the total population served throughout the sample, with the assumption that the number of properties and businesses are proportional to population.

The parameters used for the model MMDA are as follows:

| Parameter | Value |

|---|---|

| No., data collectors | 20 |

| Annual revenue, pre-dLRev, GHS million | 3.0 |

| Annual revenue, post-dLRev, GHS million | 4.7 |

| Annual revenue growth rate | 54.5% |

| No., properties | 9,956 |

The intervention is analysed over four years: the first year consisting of implementation activities (i.e. acquisition of equipment and training) and three subsequent years of revenue collection. After which, it is assumed some hardware would require maintenance or replacement.

Costs and Benefits

Costs

The dLRev is an open-source data tracking and revenue collection software and is free to use. There are several pre-conditions to be satisfied in order to qualify for the dLRev software. These pre-conditions include aerial imagery for spatial databases, street-naming and property addressing, property valuation, and fee-fixing.

The cost components for the implementation of the dLRev management software are listed below, by activity:

1. Uploading local plan to dLRev server

2. Data collection

To keep the cost of data collection at a minimum, data collection teams usually include National Service personnel, Nation Builders Corps (NABCO) and salaried district assembly staff. This process is facilitated by the GIZ programme’s regional advisors. Training for the fieldworkers is either executed by GIZ staff or consultants. During the training, the district teams (fieldworkers and district staff) are provided with user credentials to use the Data Collection App for data collection.

1. Uploading of new data/quality checks

2. Training of dLRev Management Team

This team comprises a Management Information System (MIS) Officer, Physical Planning Officer (PPO), Finance Officer, Budget Analyst and Coordinating Director. The GIZ team assigns individual user credentials to the members of the dLRev team and revenue collectors to use the system for their operations.

1. Hardware costs

2. Internet costs

3. Revenue collector training and revenue collection

The GIZ technical team visits the MMDA to provide user training to the dLRev-team for two or three days depending on their ability to grasp the operation of the system. The revenue collectors from those districts are also given a specific training on the distribution of bills (demand notices).

1. Printing of demand notices

Once an MMDA is fully setup, a new, very important and intensive phase of support begins. With printing of the demand notices (bills), and the distribution of bills, MMDA needs to change their practices of revenue management. To support the regional advisors in guiding MMDAs through this change management process, GIZ deploys consultants for several days to assist new MMDA using dLRev.

Distribution of costs over the intervention period, GHS

| Activities | Y1 | Y2 | Y3 | Y4 |

|---|---|---|---|---|

| Uploading local plan to dLRev server | 6 | |||

| Data collection | 22,000 | 40 | 40 | 40 |

| Uploading of new data/quality checks | 6 | 7 | 7 | 7 |

| Training of dLRev Management Team | 79,200 | 67,900 | 70,400 | 72,900 |

| Hardware costs | 9,100 | |||

| Internet costs | 1,500 | 1,200 | 1,200 | 1,200 |

| Revenue collector training | 12,200 | 11,300 | 11,300 | 11,300 |

| Printing of demand notices | 22,800 | 49,800 | 49,800 | 49,800 |

| Total costs | 146,900 | 130,200 | 132,700 | 135,200 |

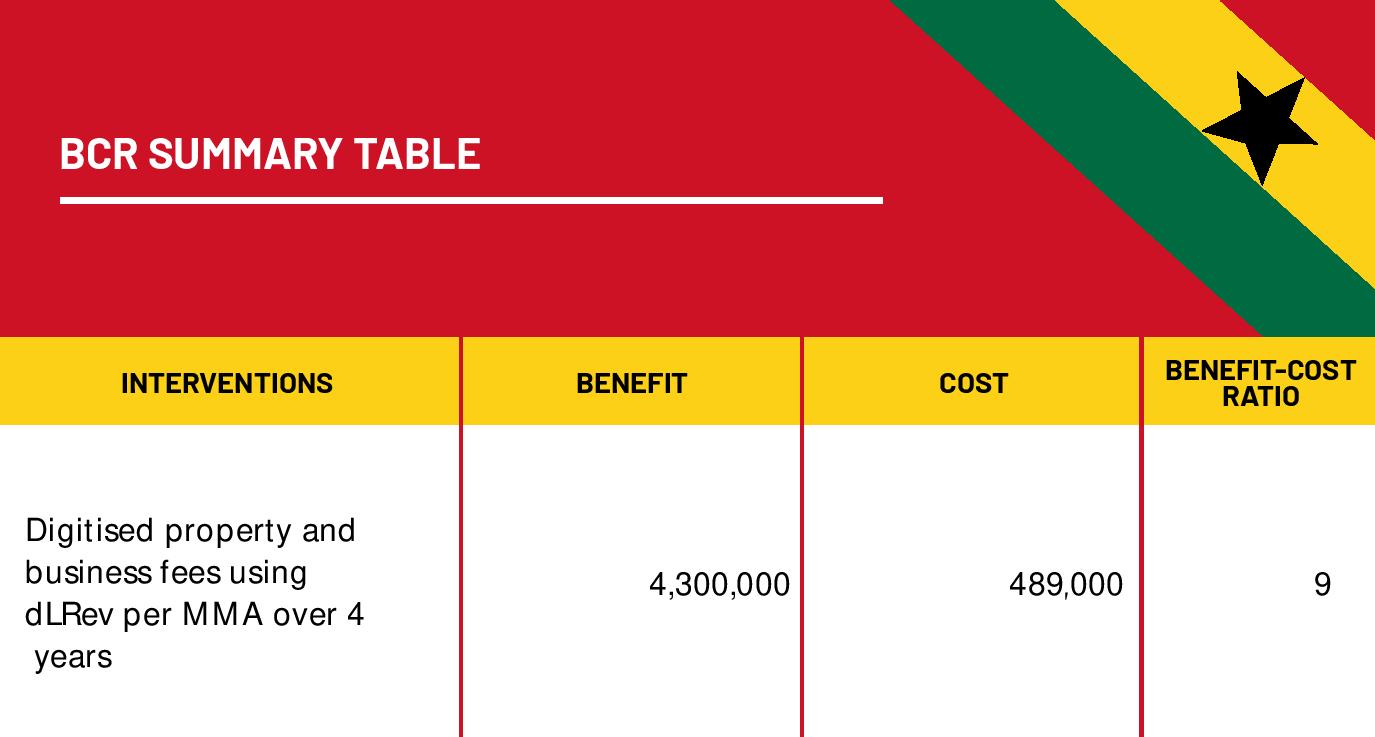

Total discounted costs (8%) are GHS 488,600 for a single MMDA.

Benefits

The anticipated benefits of digitizing revenue mobilization and management are:

Reduction in the cost of data collection

The data collection process, the identification of business and property ratepayers, was completely manual and not comprehensive, given the lack of geospatial data and addressing. The annual activity lasted approximately 120 man-days per 10,000 parcels. Providing a mobile app, the dLRev management software has reduced this to 20 man-days per 10,000 parcels. The data collectors now undergo training and use tablets to upload new information immediately to the local map.

Efficiency gains from issuing demand notices

The efficiency gains in issuing demand notices emanates from the faster printing and distribution of bills and was measured by the number of man-days it takes revenue collectors to distribute the bills, which decreased from 25 days to 2 for the municipality. The municipalities in the sample ranged from 15 to as many as 80 days to issue demand notices, prior to dLRev implementation.

Efficiency gains from paying collectors

There was also a reduction in the time it takes to prepare the paperwork to pay revenue collectors, which ranged from 20 to 80 days (weighted average 40) in the municipalities prior to dLRev and dropped to a range of 10 to 20 days (weighted average 17). In the model MMDA, it is an efficiency gain of 23 days for the municipality.

Increase in revenues

This benefit relates to better coverage of the tax base; that is, an increase in the number of ratepayers and an increase in the rate of compliance. The weighted average growth rate of revenue collected in the year after implementation of dLRev is 54%.

Benefits not captured

There are a few benefits that could not be readily measured at the time of this analysis. The widening of the tax base is one source of the increase in revenues. That is, because of the lack of mapping and addressing, there were ratepayers who were unknown to the municipality and have now been captured by the geodatabase. There is however a subgroup of pre-existing registered ratepayers, who, even after having received demand notices, failed to pay. This has been estimated to be as high as 30% (Dzansi et al., 2018). In order to identify this group, an accounting of the number of demand notices sent pre-intervention against the number of compliant ratepayers would have been needed.

Another benefit that has not been captured is the reduction in the time to process payments. The average time of 2 days remains the same. Processing time is the time from the moment when the revenue (e.g. property rate) has been collected, until the payment has been made into the MMDA’s bank account (including accounting / registration at the Finance department,). As the revenue collection process in all MMDAs was still “conventional” in 2019, there was no change in the processing time. With the introduction of fully automatized mobile / instant payments into the transaction management of dLRev in 2020, a significant reduction of processing time is expected. Automatizing the transaction management process will further reduce potential leakages.

Distribution of benefits over intervention period, GHS

| Benefits | Y1 | Y2 | Y3 | Y4 |

|---|---|---|---|---|

| Reduction, data collection cost | 100 | 100 | 100 | |

| Efficiency gains, issuing demand notices | 1,100 | 1,200 | 1,200 | |

| Efficiency gains, paying collectors | 12,400 | 12,400 | 12,400 | |

| Increase in revenues | 1,648,600 | 1,648,600 | 1,648,600 | |

| Total benefits | 1,667,100 | 1,667,300 | 1,667,600 |

Total discounted benefits (8%) are GHS 4.3 million, with the vast majority of the benefit coming from increased revenues.