Malawi Priorities: Governance

Technical Report

Key Messages

Malawi’s MSME sector contributes approximately 40% to the national GDP. Yet several obstacles restrict the growth of the MSME sector, which in turn restrict the growth of the overall economy. These include limited access to financial services such as credit and banking, limited business training, informality, high costs of complying with regulations, and an overall poor environment for conducting business. High business registration and tax compliance costs mean that only 11% of MSMEs are registered and pay tax, cutting into the government’s revenue base. Additionally, the current predominantly paper-based tax system poses a large cost to the Malawi Revenue Authority (MRA).

Malawi’s MSME sector contributes approximately 40% to the national GDP. Yet several obstacles restrict the growth of the MSME sector, which in turn restrict the growth of the overall economy. These include limited access to financial services such as credit and banking, limited business training, informality, high costs of complying with regulations, and an overall poor environment for conducting business. High business registration and tax compliance costs mean that only 11% of MSMEs are registered and pay tax, cutting into the government’s revenue base. Additionally, the current predominantly paper-based tax system poses a large cost to the Malawi Revenue Authority (MRA).- The report recommends the government improve tax e-filing and provide ‘nudges’ for firms to pay their taxes across Malawi. The MRA has already begun planning for this intervention, and this report provides economic evidence that the benefits of implementation exceed cost by a factor of 7. The intervention would reduce the tax compliance costs of MSMEs by 65% - saving compliant businesses a total of MWK 5,271 million per year in the long run. The MRA would also see savings of MWK 2,570 million annually. The intervention requires an upfront expense of MWK 1,082 million for the ICT improvements, and ongoing costs of MWK 840 million for operating the system, and MWK 57 million for tax nudges.

- The report highlights the large value that could be generated from free micro, small and medium-sized enterprise (MSME) registration accompanied by bank information seminars. Based on a pilot program from Malawi, MSMEs are expected to see an increase in revenues by 20%, mostly due to the increased availability of banking services. If half of Malawi’s MSMEs take up the service, benefits start at MWK 73,000 million rising to MWK 725,000 million by 2031. Firms are expected to incur an additional MWK 413,000 million in operating expenses by 2031. The costs of the seminar and registration are relatively low at MWK 2,000 million by 2031. For every 1 kwacha spent, the intervention returns 1.7 kwacha. While the return on investment is only fair, the net benefits are large, equivalent to 2 to 3% of Malawi's GDP in the long run.

Context

Malawi’s MSME sector contributes 40% of the total GDP. The Government of Malawi has recognized the importance of MSMEs to spur economic growth and designed its Micro, Small, and Medium-Sized Enterprise Policy 2019, which, along with the Malawi 2063 Vision document, guides the creation of a more productive business environment for MSMEs. A recent FinScope MSME survey on the size, scope, and characteristics of the MSME sector in Malawi suggested that of Malawi's 1,600,739 MSMEs in 2019, 89% were neither registered nor licensed.

The sector employs nearly two million Malawians including part-time and seasonal employees and entrepreneurs. In addition, the sector generated approximately MWK 11,771 billion (USD 15.8 billion) in revenues and about MWK 5,066 billion (USD 6.8 billion) in profits in 2019. The value additions by the formal and informal businesses in 2019 were MWK 2,682 billion (USD 3.6 billion) and MWK 2,384 billion (USD 3.2 billion), respectively.

As emphasized in Malawi 2063, the Government of Malawi targets Malawi to be among the most preferred investment destinations in Africa by 2063. Decreasing the burden of compliance by removing unnecessary regulation and bureaucracy, increasing the sector's dynamism by the maximum utilization of digital facilities, broadening the tax base, and allocating the tax returns to the country's vital infrastructure and other needs is crucial to reach that ultimate goal. Bearing these goals in mind, the analysis considers interventions that focus on the provision of MSME support services, improving the business environment within Malawi, and lowering the time costs associated with compliance.

Facilitating tax compliance through E-filing would save 65% of costs for compliant MSMEs while business registration and banking seminars could generate net benefits worth 2-3% of GDP

Intervention 1: E-filing and tax nudges facilitating compliance

This intervention looks to improve the Malawi Revenue Authority's Msonkho Online system to replace paper tax filing with electronic filing. The intervention also contains implementing tax nudges to facilitate and enhance tax compliance. These nudges take the form of a simple message to remind non-filers of the importance of paying taxes and the consequences of not paying. The intervention focuses on reducing compliance costs and facilitating payment procedures to improve businesses’ efficiency and tax compliance while improving the efficiency of the MRA.

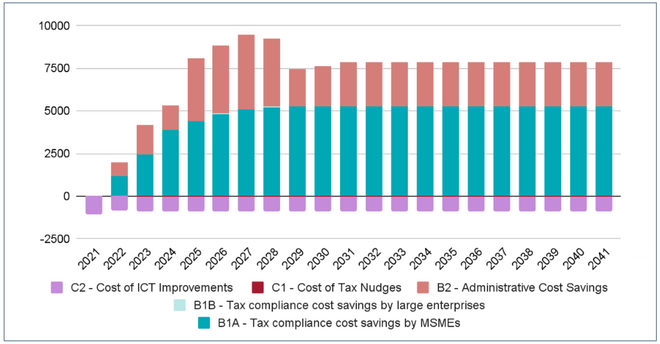

The intervention has two broad costs - the cost of upgrading and operating the ICT system for e-filing and the tax nudges. Upgrading the ICT system would cost MWK 1,139 million initially, and MWK 840 million per year after that. The tax nudges are a relatively small cost of MWK 57 million per year.

The intervention is expected to lead to two benefits - reduce tax compliance costs for firms and reduced administrative costs for MRA. Currently, firms require 1 to 1.2 full-time equivalent staff to comply with the tax laws. E-filing is expected to reduce this cost by 65% in the long run. For the 11% of firms that currently pay taxes, the savings are substantial - around MWK 5,271 million per year. The intervention also increases the administrative efficiency of the MRA. Estimates obtained from the MRA suggest savings that start at MWK 789 million initially rising to MWK 4,010 in 2026, before settling at MWK 2,570 million in the long run mostly in the form of improved staff efficiency. The return on investment from the intervention is 7, meaning that for every kwacha spent Malawian businesses and government save 7 kwachas in filing and administering taxes respectively.

Intervention 2: Business registration

The intervention provides MSMEs with free registration and banking seminars, with the expectation that this will lead owners to formalize their businesses and improve their financial practices, savings, access to credit, and benefits from insurance. Formalization increases businesses' financial inclusion that would support them to improve their business practices, get more productive, grow, and benefit from economies of scale.

In addition, the potential impact of financial inclusion on businesses' profitability increases their willingness to register, increasing the uptake rate of the intervention. While registering a business is not the same as formalization, it does increase compliance with the law and provides the government with some information about the enterprise. Though business registration on its own does little to increase performance or even formalization rates, when it is combined with complementary services such as increased access to advertising, credit, insurance, or government assistance programs, there is a significant increase in both.

Figure 1: E-filing and tax Nudges - Cash Flow Over Time

The expected impacts of the intervention are drawn from a pilot program conducted in Malawi. In that study, participating MSMEs saw an increase in revenues of 20%. This large increase was attributed mostly to the connections made to formal financial services. Both the registration and banking seminar were retained for this analysis since it was this combination that led to the greatest increase in revenues. Following the pilot, the analysis assumes 50% of offered firms take up the intervention. This would generate benefits starting at MWK 73,000 million rising to MWK 725,000 million by 2031. To realize these gains, firms are expected to incur an additional MWK 413,000 million in operating expenses by 2031. The costs of the seminar and registration are relatively low at MWK 2,000 million by 2031. For every 1 kwacha spent, the intervention returns 1.7 kwacha. While the return on investment is only fair, the net benefits are large, equivalent to 2 to 3% of Malawi's GDP in the long run.

Summary Table

| Intervention | BRC | Beneficiary Population | Costs | Benefits |

|---|---|---|---|---|

| E-filing and tax nudges | 6.9 Good (100% economic benefits) |

Firms that file taxes MRA |

Firms that file taxes MRA ICT costs: MWK 1,082 million in the first year, MWK 840 million per year after Tax nudges: MWK 57 million per year |

MWK 2.0m |

| Free MSME Registration and Bank Seminar | 1.7 Fair (100% economic benefits) |

50% of MSMEs in Malawi | Increased firm operating costs: MWK 413,000 million (long run) Banking seminar and registration costs: MWK 2,000 million over 10 years |

Increased MSME revenue: MWK 725,000 million per year (long run) |

Note: BCRs are based on costs and benefits discounted at 8% (see accompanying technical report). BCR ratings are determined on the following scale Excellent, BCR > 15; Good, BCR 5-15; Fair, BCR 1-5; Poor, BCR < 1. This traffic light scale was developed by an Eminent Panel including several Nobel Laureate economists for a previous Copenhagen Consensus project that assessed the Sustainable Development Goals.

Download the full policy brief here.